More About Clark Wealth Partners

Little Known Questions About Clark Wealth Partners.

Table of ContentsThe Buzz on Clark Wealth PartnersClark Wealth Partners - TruthsThe Ultimate Guide To Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get ThisThe Single Strategy To Use For Clark Wealth PartnersClark Wealth Partners - TruthsFacts About Clark Wealth Partners Uncovered

The world of money is a challenging one. The FINRA Structure's National Ability Research, as an example, just recently found that nearly two-thirds of Americans were not able to pass a standard, five-question monetary proficiency examination that quizzed participants on subjects such as interest, financial obligation, and various other reasonably standard ideas. It's little wonder, after that, that we frequently see headlines regreting the poor state of a lot of Americans' funds (financial advisor st. louis).In addition to handling their existing clients, monetary advisors will often spend a reasonable quantity of time every week meeting with potential clients and marketing their services to preserve and expand their service. For those thinking about becoming a financial advisor, it is very important to think about the average income and work stability for those operating in the area.

Courses in taxes, estate planning, investments, and threat administration can be handy for trainees on this path. Relying on your distinct career objectives, you might additionally need to earn details licenses to accomplish specific clients' demands, such as dealing stocks, bonds, and insurance plan. It can additionally be handy to make a certification such as a Certified Economic Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS).

Unknown Facts About Clark Wealth Partners

.jpeg?width=386&height=338&name=6%20Money%20Decisions%20Graphic%20(R).jpeg)

Lots of people make a decision to obtain assistance by making use of the services of a monetary expert. What that resembles can be a variety of points, and can vary depending upon your age and stage of life. Before you do anything, study is crucial. Some people fret that they need a specific quantity of money to invest before they can get aid from an expert.

The 5-Second Trick For Clark Wealth Partners

If you have not had any kind of experience with a monetary expert, below's what to anticipate: They'll start by offering an extensive evaluation of where you stand with your possessions, responsibilities and whether you're fulfilling standards contrasted to your peers for cost savings and retired life. They'll evaluate short- and long-lasting goals. What's handy concerning this action is that it is customized for you.

You're young and working full time, have a cars and truck or two and there are student finances to pay off.

The Ultimate Guide To Clark Wealth Partners

You can discuss the next best time for follow-up. Financial advisors typically have various tiers of rates.

You're looking ahead to your retired life and helping your children with greater education see here and learning prices. An economic advisor can provide suggestions for those situations and more.

3 Simple Techniques For Clark Wealth Partners

That may not be the ideal means to keep structure riches, especially as you advance in your occupation. Set up routine check-ins with your planner to modify your plan as needed. Balancing savings for retirement and university prices for your kids can be difficult. A monetary advisor can aid you prioritize.

Considering when you can retire and what post-retirement years might resemble can produce worries concerning whether your retired life financial savings are in line with your post-work plans, or if you have actually saved enough to leave a tradition. Help your monetary expert recognize your approach to money. If you are extra traditional with saving (and prospective loss), their recommendations should reply to your concerns and worries.

What Does Clark Wealth Partners Mean?

Planning for health care is one of the big unknowns in retirement, and a monetary specialist can describe alternatives and suggest whether additional insurance policy as protection might be valuable. Prior to you begin, try to get comfortable with the idea of sharing your entire financial image with a specialist.

Offering your specialist a full image can aid them produce a strategy that's prioritized to all components of your economic standing, specifically as you're fast approaching your post-work years. If your funds are straightforward and you have a love for doing it on your own, you might be great on your very own.

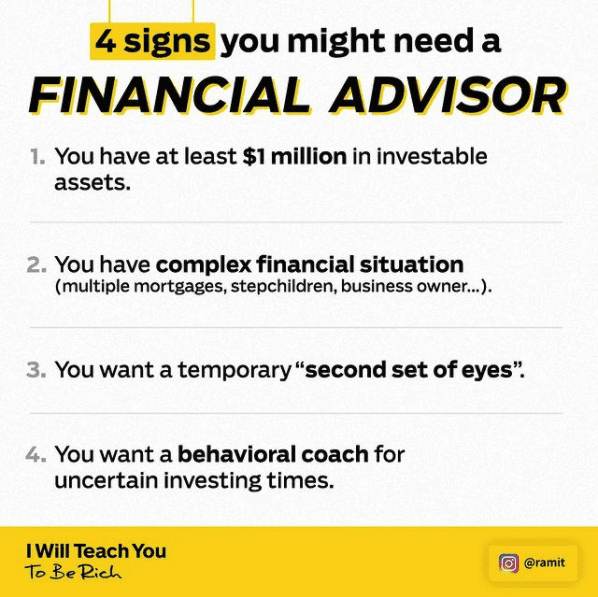

An economic expert is not just for the super-rich; any person encountering major life changes, nearing retired life, or sensation bewildered by monetary choices can gain from expert advice. This short article checks out the role of economic experts, when you may require to consult one, and vital factors to consider for choosing - https://www.pearltrees.com/clrkwlthprtnr#item764008498. A financial consultant is a skilled specialist that assists clients handle their financial resources and make notified decisions that align with their life objectives

7 Simple Techniques For Clark Wealth Partners

In contrast, commission-based consultants earn revenue via the financial products they sell, which might influence their recommendations. Whether it is marriage, separation, the birth of a youngster, profession changes, or the loss of an enjoyed one, these events have one-of-a-kind economic effects, usually needing prompt decisions that can have long lasting impacts.